Introduction: What Is Crypto Trading?

Crypto trading refers to the process of buying and selling crypto assets such as Bitcoin, Ethereum, and various other cryptocurrencies for the primary goal of earning profit. Unlike stock trading, the crypto market operates 24/7 and is highly volatile which brings both risk and opportunity.

As the total crypto market cap is projected to exceed $2 trillion in 2025, more and more people are getting into digital assets. Whether you want to trade for a profit in the short term or invest for the long-term, it is important to know about the basics.

Why Crypto Trading Is Gaining Popularity

Crypto trading offers benefits that traditional financial systems lack:

- Decentralization: No central authority controls cryptocurrencies.

- High volatility: Traders can make (or lose) significant profits in short periods.

- Accessibility: Anyone with an internet connection can start trading.

According to a 2025 Statista report, over 420 million people are involved in crypto worldwide, a number expected to grow rapidly as blockchain technology matures.

Different Types of Crypto Trading

There are several crypto trading styles, each suited to different goals and risk levels:

1. Day Trading

Day traders open and close positions within the same day, profiting from short-term price movements.

2. Swing Trading

Swing traders hold assets for several days or weeks to capitalize on broader price moves.

3. Scalping

Scalpers make dozens or hundreds of trades daily, profiting from tiny price fluctuations.

4. HODLing (Long-term Investment)

HODLing involves buying crypto and holding it for months or years, banking on long-term appreciation.

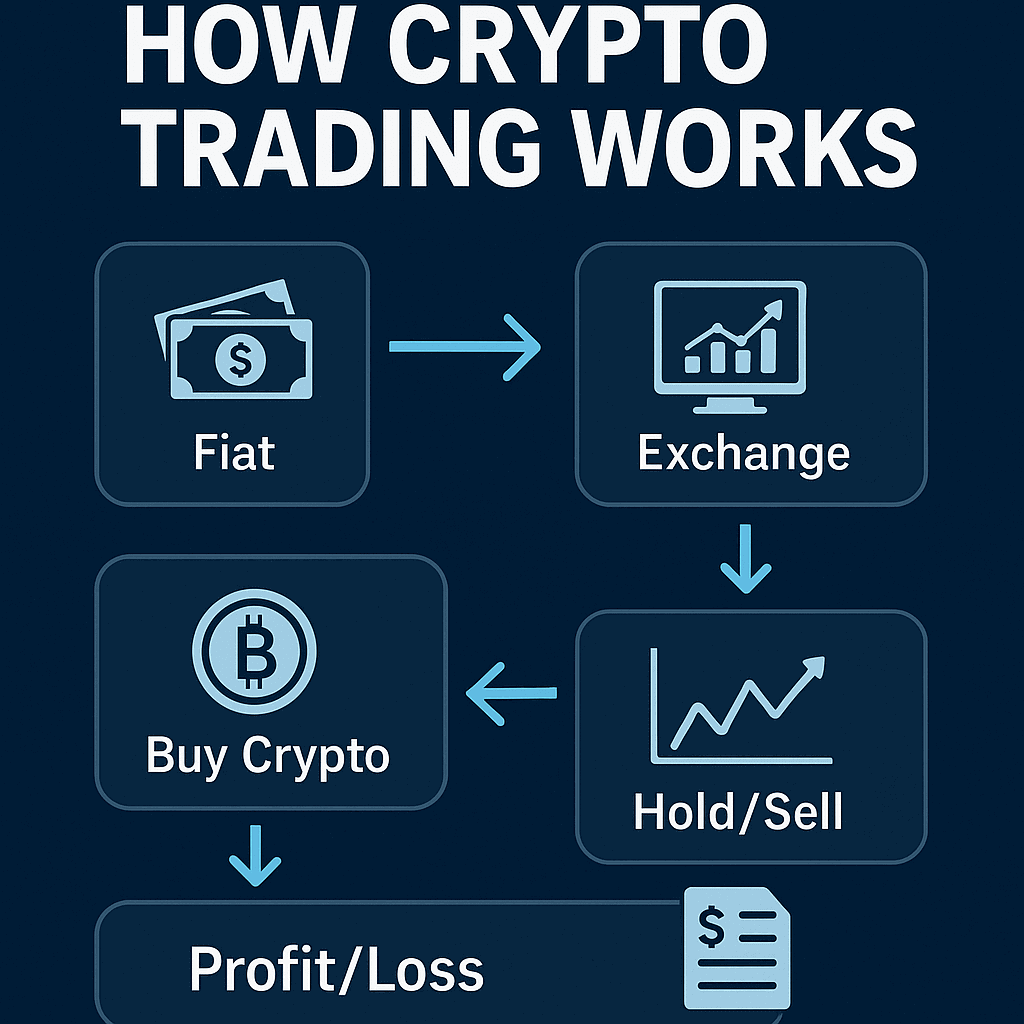

How to Start Crypto Trading in 2025

Step 1: Choose a Reliable Exchange

Popular options include:

- Binance

- Coinbase

- Kraken

- Bybit

- KuCoin

Make sure the exchange offers strong security, a user-friendly interface, and reasonable fees.

Step 2: Create an Account and Verify Identity

Most exchanges require KYC (Know Your Customer) verification for security and legal compliance.

Step 3: Fund Your Wallet

You can deposit fiat (USD, EUR) or transfer crypto from another wallet.

Step 4: Start Trading

Choose your pair (e.g., BTC/USDT), analyze the market, and execute trades using limit or market orders.

Essential Tools for Crypto Traders

- Charting Platforms: TradingView, Coinigy

- Portfolio Trackers: CoinStats, Blockfolio

- News Aggregators: CoinTelegraph, Decrypt

- Community Forums: Reddit r/CryptoCurrency, Twitter, Telegram

These tools help you stay informed, analyze trends, and make data-driven decisions.

Key Technical Indicators for Crypto Trading

Technical analysis is crucial for traders to understand trends and predict price movements. Here are key indicators:

- Moving Averages (MA)

- Relative Strength Index (RSI)

- MACD (Moving Average Convergence Divergence)

- Bollinger Bands

- Fibonacci Retracement

Common Mistakes New Traders Make

Avoid these common pitfalls:

- FOMO (Fear of Missing Out): Chasing after a coin after it has pumped often leads to losses.

- Lack of Strategy: Always trade with a clear plan and risk management strategy.

- Ignoring Security: Failing to use 2FA or storing crypto on exchanges can lead to theft.

Risk Management in Crypto Trading

Risk management separates successful traders from gamblers. Here’s how:

- Never invest more than you can afford to lose

- Use Stop-Loss Orders

- Diversify your portfolio

- Don’t trade emotionally

Taxes and Legal Considerations

Crypto trading is taxable in most countries. You may be required to pay:

- Capital Gains Tax: On profits made from selling crypto

- Income Tax: On staking or mining rewards

Always consult a tax professional or use crypto tax software like Koinly or CoinTracker.

Related Post: https://mohatop7.com/cryptocurrency-cryptocurrency/

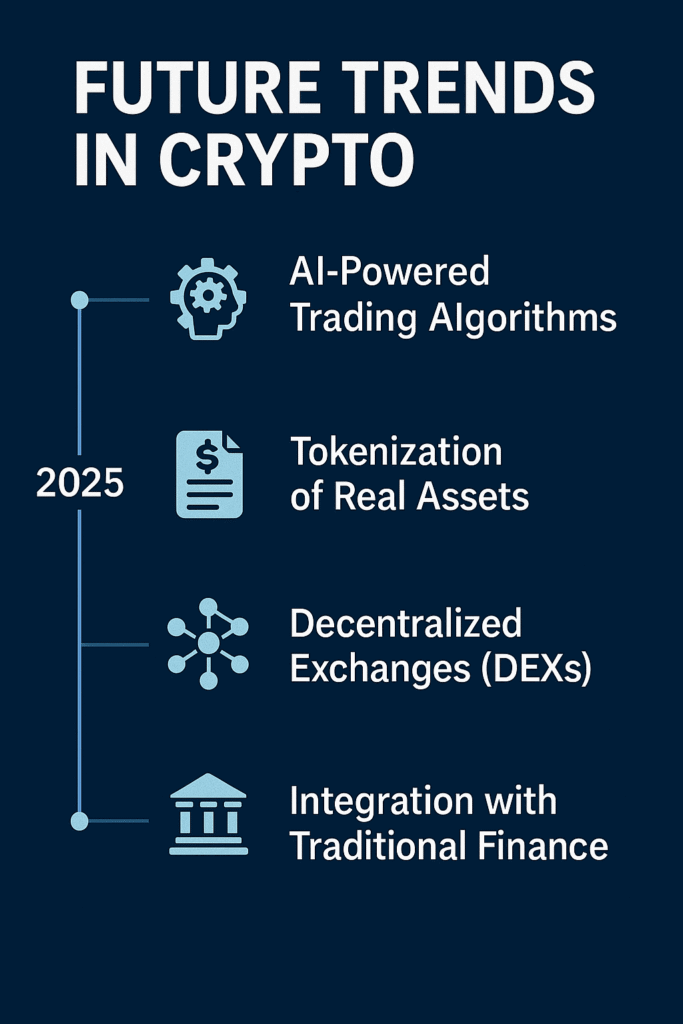

The Future of Crypto Trading in 2025 and Beyond

With increasing institutional adoption and the rise of AI trading bots, the future of crypto trading is more automated and accessible than ever.

Trends to watch:

- AI-Powered Trading Algorithms

- Tokenization of Real Assets

- Decentralized Exchanges (DEXs)

- Integration with Traditional Finance

Check on Amazon: The Crypto Trader and Crypto Investing

Final Tips for Successful Crypto Trading

- Educate Yourself Continuously: The crypto space evolves fast.

- Use Demo Accounts: Practice without risking real money.

- Follow Reliable Influencers: But never blindly copy trades.

- Keep Up with News: Regulatory changes can drastically affect prices.

Conclusion: Is Crypto Trading Right for You?

Crypto trading is an exhilarating, risky endeavor that requires discipline, continual education, and a sound market knowledge. It can be an effective market to build wealth if pursued properly.

Whether you plan on trading crypto day-to-day, long-term investing, or dipping your toes into a different financial world, crypto trading is a directional avenue to explore — with caution and a plan in mind.