Best life insurance: Looking for the right life insurance as a senior can be difficult; but with the increase in medical care costs and the variety of policy types that have become available to seniors, it can become even more complicated. However, there is hope for seniors because many of the life insurance companies now provide low-cost, simplified, and flexible insurance plans specifically designed for those who are at least 50 years old or older.

This ultimate guide will outline which life insurance policies will be available to seniors in the years 2026, how to qualify for them, and which life insurance providers have the best rates and benefits for seniors.

Why Seniors Need Life Insurance in 2026

Life insurance isn’t just for young families. Seniors choose coverage for several important reasons:

- To cover final expenses including funeral costs, which now average $8,000–$15,000.

- To leave financial support for a spouse or loved ones.

- To pay off debts such as medical bills, loans, or remaining mortgage balances.

- To leave a tax-free legacy or charitable contribution.

And with modern simplified-issue policies, seniors can often get approved without a medical exam.

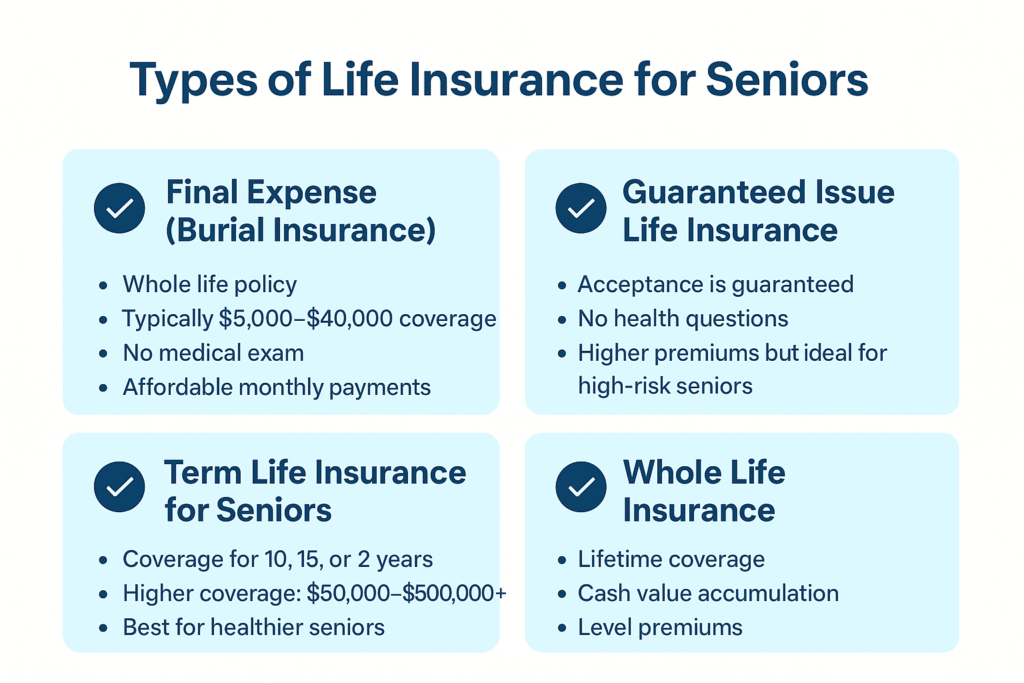

Types of Life Insurance for Seniors

Understanding the main options helps you choose the best life insurance based on your age, health, and financial goals.

1. Final Expense (Burial Insurance)

- Whole life policy

- Typically $5,000–$40,000 coverage

- No medical exam

- Affordable monthly payments

Best for: Seniors aged 60–85 who want simple, guaranteed coverage.

2. Guaranteed Issue Life Insurance

- Acceptance is guaranteed

- No health questions

- Higher premiums but ideal for high-risk seniors

Best for: Seniors with serious health conditions.

3. Term Life Insurance for Seniors

- Coverage for 10, 15, or 20 years

- Higher coverage: $50,000–$500,000+

- Best for healthier seniors

Best for: Seniors with financial dependents or loans.

4. Whole Life Insurance

- Lifetime coverage

- Cash value accumulation

- Level premiums

Best for: Seniors wanting permanent coverage and long-term value.

Related Article: https://mohatop7.com/personal-development/

Best Life Insurance Policies for Seniors in 2026

Here are the top providers offering strong benefits, affordable premiums, and senior-friendly underwriting.

1. Mutual of Omaha – Best Overall for Seniors

Why it’s great:

- No medical exam

- Fast approvals

- Affordable rates for ages 50–85

- Excellent customer satisfaction

Best for: Seniors seeking reliable final expense coverage.

2. AIG Guaranteed Issue – Best for High-Risk Seniors

Why it’s great:

- Guaranteed acceptance up to age 80

- No medical questions

- Ideal for seniors with major pre-existing conditions

Best for: Seniors who’ve been denied life insurance elsewhere.

3. State Farm – Best Term Life for Seniors

Why it’s great:

- Term policies up to age 75

- Competitive rates

- Strong financial stability

Best for: Seniors who want higher coverage for limited years.

4. Transamerica – Best Budget-Friendly Option

Why it’s great:

- Low-cost burial insurance

- Flexible coverage

- Accepts seniors up to age 85

Best for: Seniors on a fixed income.

5. New York Life – Best Whole Life for Seniors

Why it’s great:

- Cash value growth

- Lifetime protection

- Premium stability

Best for: Seniors wanting permanent coverage with investment benefits.

Comparison Table: Best Life Insurance Policies for Seniors (2026)

| Provider | Best For | Medical Exam | Age Range | Coverage Amount |

|---|---|---|---|---|

| Mutual of Omaha | Overall | No | 50–85 | $5,000–$40,000 |

| AIG | High-risk seniors | No | 50–80 | $5,000–$25,000 |

| State Farm | Term life | Optional | 50–75 | $50,000–$300,000+ |

| Transamerica | Budget-friendly | No | 55–85 | $1,000–$50,000 |

| New York Life | Whole life | Yes/No | 50–80 | $25,000–$500,000+ |

How to Choose the Best Life Insurance as a Senior

Before applying, consider these key factors:

Your Age & Health

Older age = higher premiums. Choose no-exam options if health is a concern.

Your Budget

Pick a policy with level premiums so payments never increase.

Policy Type

Term for temporary needs, whole life for lifetime or final expenses.

Financial Strength of the Company

Choose reputable insurers with AM Best “A” ratings.

Tips to Get the Best Life Insurance Rates as a Senior

- Compare at least 3–5 companies.

- Avoid tobacco use for lower premiums.

- Choose simplified-issue or guaranteed policies if you have health issues.

- Lock in a rate earlier—premiums rise every year you wait.

Also Check: https://www.cnbc.com/select/best-life-insurance-seniors/

Conclusion

Finding the best life insurance for seniors can be easy. Whether you’re looking for the most affordable final expense coverage, guaranteed issue policy, or comprehensive term coverage (or all of these), there are many great policies to choose from in today’s (2026) market.

The best way to find the right life insurance is to choose a good company, find the right kind of policy, and get a fixed premium. With the right coverage and support, your family will be taken care of for many years to come!

FAQ — Best Life Insurance for Seniors

Q1: What is the best life insurance for seniors?

A1: The best life insurance for seniors depends on your needs — final expense (no-exam), guaranteed-issue, term, or whole life. Compare cost, coverage, and health requirements.

Q2: Can seniors get life insurance with pre-existing conditions?

A2: Yes. Guaranteed-issue policies and some simplified-issue plans accept seniors with serious health issues — though premiums and waiting periods may be higher.

Q3: Do seniors need a medical exam to qualify?

A3: Not always. Many final-expense and guaranteed-issue policies require no medical exam; simplified-issue policies may ask health questions only.

Q4: How much life insurance should a senior buy?

A4: Typical targets are $5,000–$50,000 for final expenses or higher ($50k+) if you need to cover debts, mortgage balance, or provide for dependents.

Q5: Are life insurance benefits taxable for beneficiaries?

A5: Generally, life insurance death benefits are income-tax free for beneficiaries. Exceptions can apply (e.g., transferred policies or estate taxes).

Q6: What’s the difference between final expense and term life for seniors?

A6: Final expense (whole life) is permanent, small-coverage for funeral costs. Term life offers larger coverage for a set period but may be harder/expensive for older ages.

Q7: How can seniors get the lowest premium?

A7: Compare multiple insurers, avoid tobacco, consider simplified-issue policies if healthy, and buy earlier (younger) to lock lower rates.

Q8: How long do guaranteed-issue policies wait before paying full benefits?

A8: Many guaranteed-issue plans have a graded/waiting period (often 2–3 years) where only limited benefits apply; check policy terms carefully.